(Bloomberg) —

![eafd9]3c4epf7dcz29oc(z1}_media_dl_1.png](https://smartcdn.gprod.postmedia.digital/financialpost/wp-content/uploads/2022/09/us-real-yields-are-pointing-to-further-fall-in-european-tech.jpg?quality=90&strip=all&w=288&h=216)

Article content material

(Bloomberg) —

Commercial 2

Article content material

Rampant inflation has been on the core of this yr’s equities selloff and it’s not going away. Now comes the onerous half: positioning for it.

Article content material

In idea, steeply rising costs ought to favor cheaper, so-called worth shares equivalent to banks, whereas denting progress shares. Curiosity-rate hikes to maintain costs in verify imply greater earnings for lenders, whereas hurting the likes of expertise shares by creating a bigger low cost for the current worth of future earnings.

But with a recession on the horizon, it’s not so easy. Companies whose merchandise are most vulnerable to a value squeeze equivalent to retailers, leisure suppliers and homebuilders are considered as being most prone to slowing economies, whereas these with higher pricing energy, like shopper staples and well being care, are buying and selling at large premiums to the broader market as buyers flock towards safer havens.

Commercial 3

Article content material

“There’s an inflation recalibration occurring and that comes with extreme, necessary penalties from an fairness market perspective,” mentioned Wouter Sturkenboom, chief funding strategist for EMEA and APAC at Northern Belief. “Buyers are taking a look at this world via a brand new lens and it’s extra inflation-focused and extra danger reduction-focused,” he mentioned in an interview.

Within the circumstances, any indicators of an easing in costs are prone to be taken positively. “It’s the course of inflation that issues for share costs,” mentioned Liberum Capital Ltd. strategist Joachim Klement. “Each decline in inflation reduces among the price pressures firms face.”

Right here’s a take a look at how Europe’s inflation disaster is enjoying out throughout sectors.

Commercial 4

Article content material

Commodities

Power is the one European sector within the inexperienced this yr, boosted by the surge in oil costs. And analysts aren’t ruling out additional good points. Credit score Suisse Group AG lifted worth targets throughout the sector on Friday, citing high choose Shell Plc and TotalEnergies SE as shares that will outperform additional.

Renewable shares, in the meantime, are seen as long-term winners as nations make investments closely to scale back reliance on fossil fuels and imports from Russia.

For mining shares, the outlook is much less sure. Whereas they have an inclination to outperform during times of elevated inflation, good points could also be curtailed by concern about China’s demand for metals as a result of nation’s housing downturn and the financial impression of its Covid-zero coverage, in line with Morgan Stanley analysts together with Alain Gabriel.

Commercial 5

Article content material

Banks

The sector, which falls into the worth class, is rising as an inflation winner, exhibiting the most effective efficiency amongst business teams in Europe this month. Increased rates of interest to chill costs imply greater earnings on lending.

Financial institution of America Corp. analyst Alastair Ryan says the sector may see an 88 billion-euro ($88 billion) enhance to web curiosity revenue enhance from anticipated fee hikes. “This very massive income increment is why we stay constructive on the banks within the face of troubles elsewhere,” he wrote in a observe.

On the flip aspect, lenders face worries over the amount of dangerous money owed that would materialize throughout the impending recession, which can clarify why rising bond yields haven’t supplied an even bigger enhance than they’ve.

Commercial 6

Article content material

Staple Items

Pricing energy is vital throughout inflationary durations. Companies which might be in a position to defend their margins as prices rise — like shopper staples, well being care and grocers — are prone to be favored, says James Athey, funding director at Abrdn Plc.

But inflation additionally poses dangers to European staples. In line with Morgan Stanley analysts together with Pinar Ergun, customers within the area are extra susceptible to rising residing prices than elsewhere on this planet because of an unstable geopolitical backdrop and the power disaster.

“Buyers respect the defensiveness of the sector, however at present valuation ranges, many alternatives have turn out to be prohibitive,” they mentioned.

Retail

Retailers are the worst-performing business group in Europe this yr, and inflation has loads to do with it. With budgets crimped by the price of every thing from meals to power to mortgages, customers don’t have as a lot left for purchasing, whereas rising prices are consuming into profitability too.

Commercial 7

Article content material

It’s “a depressing image for retail shares,” mentioned Charles Hepworth, funding director at GAM Investments. “Disposable incomes of most customers have been massively squeezed, and trade-down substitutions into cheaper manufacturers is hardly the most effective fillip for any hope of a consumer-led restoration,” he wrote.

Luxurious attire could also be amongst safer bets. Sophie Lund-Yates, an analyst at Hargreaves Lansdown Plc, favors companies equivalent to LVMH, with clients of its Louis Vuitton model “much less prone to be damage by the downturn in actual wages.”

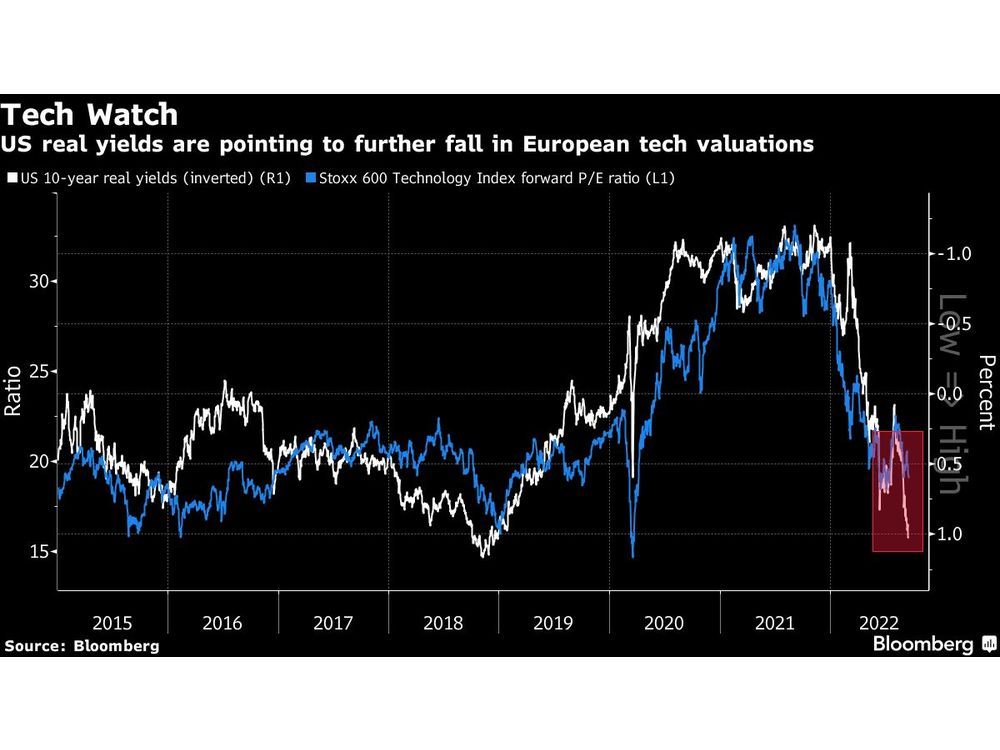

Expertise

As a core a part of the expansion class, expertise shares have been on the forefront of this yr’s international fairness rout because of surging bond yields. And regardless of its underperformance, the sector “stays very costly,” in line with Barclays Plc strategist Emmanuel Cau.

Commercial 8

Article content material

“With burgeoning indicators of decrease demand coming from semiconductors, demand destruction will be the subsequent shoe to drop,” Cau mentioned.

Development, Actual Property

Development faces a precarious outlook. The business is “anxiously ready to see how the double headwinds of squeezed budgets and rising charges will impression demand,” says Danni Hewson, analyst at AJ Bell. Homebuilders like Barratt Developments Plc and Persimmon Plc have plunged greater than 40% this yr, whereas Hewson says suppliers to the sector is also in danger. HeidelbergCement AG and Travis Perkins Plc are amongst shares to look at.

In the meantime, Goldman Sachs Group Inc. analyst Jonathan Kownator warned on Friday of escalating macroeconomic dangers for industrial actual property, downgrading Land Securities Group Plc, British Land Co Plc and Aroundtown SA. The sector has a really excessive unfavourable correlation with bond yields, he mentioned.