- Pickup of income, good efficiency from OpCos, more likely to exceed Headline KPIs

- Seems to be to finalising 5G business particulars with DNB so prospects will profit

Axiata Group Bhd recorded sturdy operational efficiency for the primary half of the 12 months ended June 30, 2022 (1H22) reflecting the stable fundamentals of its Working Corporations (OpCos) in opposition to a backdrop of inflationary pressures, larger rates of interest, and foreign exchange losses stemming from the strengthening US greenback.

Axiata Chairman Shahril Ridza Ridzuan stated, “For the primary half of 2022, the Board is inspired by the continued self-discipline and perseverance of the working corporations in executing the Group’s plans.”

On observe to exceed Headline KPIs for 2022, the Group has additionally launched into proactive measures to resist fast challenges from macroeconomic dangers by recalibrating its operations for enhanced resilience and sustainable long-term progress.

On a reported foundation, the Group’s 12 months-to-Date (YTD) income and Earnings Earlier than Curiosity, Tax, Depreciation and Amortisation (EBITDA) elevated by 5.8% and seven.4% respectively, primarily contributed by all OpCos besides Dialog4 and Ncell5.

Revenue After Tax and Minority Curiosity (PATAMI) slipped right into a lack of US$33.35 million (RM149 million) largely on account of unrealised foreign exchange losses from Dialog and Axiata as a result of strengthening US greenback, larger taxes within the type of the one off Cukai Makmur in Malaysian entities and surcharge tax in Dialog and web finance value.

On an underlying foundation, income excluding system (ex-device) grew by 7.9%, while EBITDA grew 8.1% correspondingly, offset by larger taxes and web finance value. EBITDA margin improved to 44.9% whereas EBIT expanded by 34.0%, trickling right down to Underlying PATAMI which steadily grew by 37.5%.

The upper EBITDA contribution by all OpCos besides Dialog and Ncell was additionally buoyed by the absence of accelerated depreciation of 3G belongings in 2022, offsetting larger taxes and web finance value.

Inside the quarter, Axiata achieved value excellence by way of capital expenditure and operational expenditure financial savings of US$86.84 million (RM388 million) and RM257 million, totaling RM645 million in financial savings.

[RM1 = US$0.224]

The Group’s stability sheet mirrored its growth-fueled actions, with a Gross debt/EBIDTA of three.03x, web debt/EBITDA of two.48x and money stability of RM6.6 billion.

Digital celcos efficiency

Celcom maintained its year-on-year progress momentum with income ex-device up by 4.2% YTD pushed by pay as you go income and optimistic contribution from new acquisitions in Celcom’s B2B enterprise unit. EBITDA grew by 13.0% on the again of decrease opex and debt restoration. EBIT and PATAMI improved >100% with PATAMI rising to RM542 million flowing by way of from larger EBIT, offset by larger taxes from Cukai Makmur.

XL’s income ex-device elevated by 8.5% benefitting from reopening throughout Lebaran and optimistic momentum from worth enhancements. EBITDA lagged income progress on account of larger opex to drive income, and consequently EBIT margin slid to 11.6% compounded by larger D&A. PATAMI dropped by 14.1% on account of decrease one-off features and better web finance value.

Robi’s income ex-device rose by 3.2% in tandem with larger knowledge subscribers and utilization. EBITDA and EBIT outpaced topline at 9.1% and 12.1% respectively. Nevertheless, PATAMI dropped by 65.8% because of foreign exchange losses on USD-denominated loans and better web finance value.

Towards a difficult socioeconomic local weather, Dialog’s resilient topline was negated by foreign exchange losses on account of depreciation of the Sri Lankan Rupee (LKR) in opposition to the greenback. Income ex-device elevated by 20.3% YTD attributed to larger contributions throughout all segments. PATAMI dropped to a lack of LKR28.3 billion considerably impacted by foreign exchange losses, with out which, PATAMI would have been LKR6.0 billion.

Ncell’s income ex-device slipped by 4.4% pushed by decrease core posting of 1.9% and on account of decrease home interconnect charge whereby voice had dropped 11.3% whereas knowledge moderated the downturn with a progress of 17.6%. The ensuing EBIT and PATAMI had declined by 18.8% and 24.1% respectively.

Sensible continued its upward momentum as income ex-device rose by 6.5% YTD on the again of sturdy knowledge progress of 11.7% from elevated knowledge subscribers and utilization. EBITDA elevated by 5.3% which was moderated by larger direct value. Within the meantime, PATAMI elevated by 14.2% in view of one-off funding impairment of monetary companies prior to now monetary 12 months.

Digital Companies

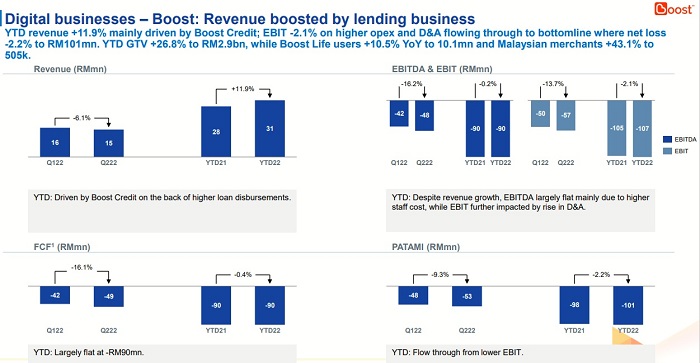

Enhance’s income elevated by 11.9% YTD primarily attributed to Enhance Credit score. EBIT and PATAMI narrowed by 2.1% and a pair of.2% respectively. Regardless of this, operational metrics continued to be sturdy, as YTD gross transactional worth grew by 26.8% to RM2.9 billion, whereas Enhance Life customers grew by 10.5% year-on-year and Malaysian service provider touchpoints grew by 43.1% to 505,000.

ADA10 sustained its income enlargement with a 14.9% progress YTD, primarily pushed by Buyer Engagement, and eCommerce options which was bolstered by the acquisitions of Awake Asia in 2021 and SingPost’s eCommerce unit in Could 2022. EBITDA and PATAMI slid by 4.8% and 17.6% respectively on account of larger opex and taxes.

Infrastructure

edotco’s income rose by 23.7% YTD benefitting from the inorganic acquisition of Contact Mindscape in Malaysia and natural contribution, significantly in Bangladesh. Inorganic progress together with natural B2S rollout and colocation had been equally mirrored in YTD EBITDA progress of 32.5% and YTD EBIT progress of 37.4%. PATAMI slid marginally by 7.8%, primarily brought on by unrealised foreign exchange translation loss, larger web finance value and tax expense from Cukai Makmur.

If excluding foreign exchange impression, PATAMI elevated by 35.6% YTD.

Overview of the 1H22 by the Board and Executives

Chairman Shahril stated, “For the primary half of 2022, the Board is inspired by the continued self-discipline and perseverance of the working corporations in executing the Group’s plans. I’m happy to report that Axiata’s future-proofing efforts are on observe, together with the Celcom-Digi merger, completion of Hyperlink Web acquisition and enlargement of edotco’s tower portfolio. The Board has additionally been working carefully with the management workforce to navigate the present atmosphere to anchor the Group’s companies in opposition to macroeconomic uncertainties and business developments.”

“On 5G in Malaysia, we’re nearer to having a standard alignment between the varied stakeholders within the spirit of creating a sustainable ecosystem. Axiata appears to be like ahead to finalising entry and business particulars with Digital Nasional Bhd so shoppers and enterprises will profit from subsequent era options because the nation accelerates digitally.”

“Axiata’s ESG commitments recorded additional traction with the formalisation of its Board Sustainability Committee in April 2022 to strengthen and oversee ESG issues throughout the Group. Axiata’s Variety, Fairness and Inclusion (DEI) Framework protecting 4 areas of Gender, Skills, Generations and Ethnicities, was additionally launched throughout the quarter,” Shahril added.

In the meantime Axiatas joint performing CEO Vivek Sood stated, “With COVID-19 impacts clearly behind us, a majority of our working corporations have delivered stable operational leads to the primary half of 2022, principally outperforming of their markets. With the improved operational efficiency, we’re more likely to exceed the headline KPIs for the 12 months each by way of income excluding system in addition to EBIT progress.”

“Foreign exchange impression and macro headwinds particularly in Sri Lanka, Bangladesh and Nepal had adversely impacted Group earnings. To stem the tide, our fast focus will probably be directed in the direction of integrating new acquisitions, managing USD liquidity and inflation particularly in frontier markets and easing out the stability sheet stretch.”

Joint Appearing CEO Dr Hans Wijayasuriya added, “Within the medium-term, we’re cognisant of dangers comparable to elevated power prices, world chip provide shortages and better rates of interest. We’re additionally conserving a detailed watch on the impression of M&A transactions particularly the timing of completion, impression to gross debt/EBITDA and supply of synergies.”

“Shifting ahead, we’re assured of the learnings that may be utilized group extensive from Venture Resilience – a Collective Mind initiative being piloted to regular Dialog in opposition to intense headwinds and macroeconomic pressures.”

Aiming to aggressively undertake know-how and analytics to boost product, community and the service expertise, Dr Hans careworn that in the end, the purpose is to boost resilience and drive long-term worth creation group-wide to learn the purchasers and communities Axiata serves as a regional digital champion.