[ad_1]

Good Morning!

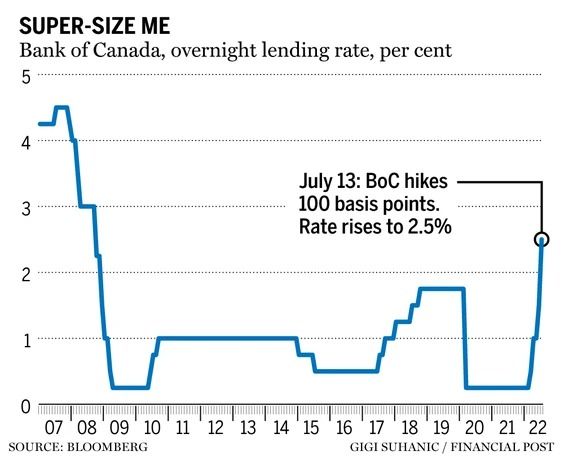

The Financial institution of Canada’s 100-basis-point hike was like taking a “hammer” to the housing market, setting it up for a good deeper correction subsequent 12 months, says a BMO senior economist.

“The truth that the market had already cracked after the BoC’s preliminary transfer in charges solely strengthened how sentiment-driven the market was, and the way rapidly that may change,” BMO’s Robert Kavcic stated in a current word.

The abrupt shift in sentiment was obvious even earlier than the Financial institution’s supersized hike on July 13 with a survey carried out the week earlier than revealing that extra Canadians now count on decrease house costs forward fairly than increased, stated Kavcic.

The Nanos survey discovered that simply 30% now count on increased costs, down from nearly 70% on the peak of the pandemic housing growth.

“We’ve argued all alongside that there was a significant behavioural facet to what was occurring in Canadian housing, the place acute worth positive factors have been pushed by FOMO, hypothesis and funding exercise,” wrote Kavcic. “Certainly, the proof is that even simply an preliminary nudge in rates of interest was sufficient to crack expectations and set off a correction. The newest transfer by the Financial institution of Canada will wash away any remaining froth.”

Borrowing prices have gone from 1.5% firstly of the 12 months to about 4.5% in a matter of six months which is a “huge tablet for the market to swallow,” stated Kavcic.

Qualifying charges are additionally rising. The stress take a look at, the upper of 5.25% or 200 bps above the contract fee, has now risen to six% for variable fee mortgages and seven% for fastened.

“So, in contrast to earlier rounds of tightening, this transfer now additionally begins to carve into buying energy on paper,” he stated.

The swift rise in rates of interest and weakening financial outlook has prompted different economists to downgrade their forecasts for Canada’s housing market.

Oxford Economics — already on the bearish finish of the spectrum with their earlier forecast of a 24% house worth correction — now see a bigger 27% peak-to-trough drop in costs by the primary quarter of 2024.

Sadly, falling costs aren’t anticipated to make Canadian housing extra inexpensive any time quickly. The studying on Oxford’s house affordability index within the first quarter of this 12 months confirmed the standard house worth was 51% above the borrowing capability of median-income households — a report for the index that dates again to 2005.

“Now rising rates of interest are creating a brand new headwind for households, driving affordability additional into unprecedented territory,” stated Oxford.

It expects the house worth to rise to 72% above the median borrowing capability by the third quarter as increased mortgage charges offset decrease house costs.

The excellent news is that affordability ought to begin to enhance as mortgage charges peak late within the 12 months, Oxford stated.

_____________________________________________________________

[ad_2]