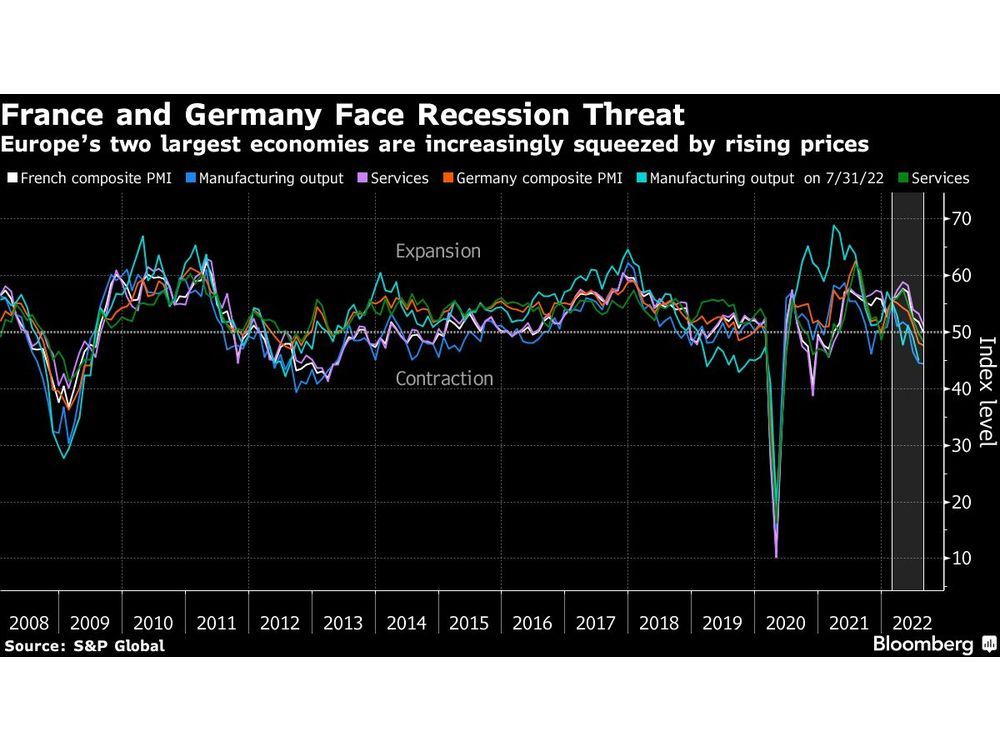

French output is contracting for the primary time in a 12 months and a half, mirroring the development seen in Germany as Europe’s greatest economies succumb to file inflation and growing uncertainty from the conflict in Ukraine.

Article content

(Bloomberg) — French output is contracting for the first time in a year and a half, mirroring the trend seen in Germany as Europe’s biggest economies succumb to record inflation and increasing uncertainty from the war in Ukraine.

Article content

A gauge of French private-sector activity by S&P Global dropped in August to its lowest level since the pandemic-related disruptions of early 2021. It fell more than economists had expected, dipping below the threshold that separates expansion from contraction.

New orders declined in both services and manufacturing, with firms the least confident since November 2020. Overall, service activity remained just above the level that indicates expansion, while manufacturing plummeted.

“High inflation and a waning post-Covid boost to demand has led businesses and consumers to cut back on discretionary spending,” said Joe Hayes, an economist at S&P Global. “European economies look set for a challenging run into year-end.”

Article content

A recession in the 19-member euro zone is now more likely than not as energy costs spike following Russia’s attack on its neighbor, according to analysts surveyed by Bloomberg. The continent, already enduring the fastest price gains since the common currency was introduced, is also bracing for further increases in interest rates after the European Central Bank hiked borrowing costs last month for the first time since 2011.

In Germany, which relies more than most on the Kremlin for natural-gas supplies and is facing the prospect of shortages this winter, output began to shrink in July and contracted again in August, S&P Global said in a separate release.

Europe’s No. 1 economy is seeing a “deepening decline in private-sector business activity,” said Phil Smith, economics associate director at S&P Global Market Intelligence, describing the outlook as “riddled with uncertainty.”

“Continued weakness in manufacturing is being compounded by a slowdown in the service sector, with surveyed businesses reporting a growing strain on demand from high inflation and increased interest rates,” Smith said.