[ad_1]

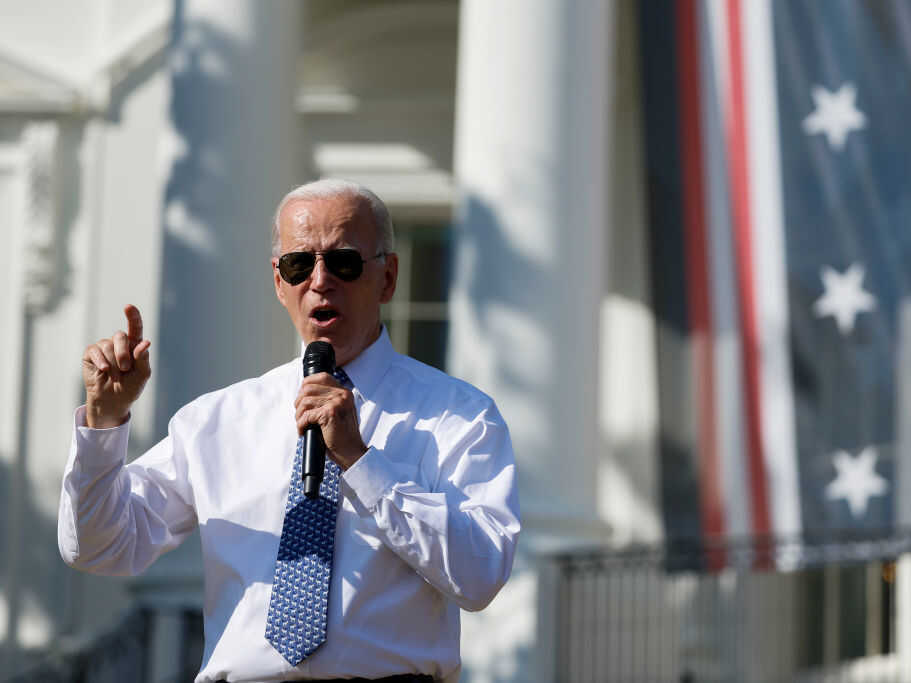

U.S President Joe Biden speaks throughout an occasion celebrating the passage of the Inflation Discount Act on the South Garden of the White Home on September 13, in Washington, DC. The brand new legislation offers Medicare the facility to barter drug costs.

Anna Moneymaker/Getty Photographs

disguise caption

toggle caption

Anna Moneymaker/Getty Photographs

U.S President Joe Biden speaks throughout an occasion celebrating the passage of the Inflation Discount Act on the South Garden of the White Home on September 13, in Washington, DC. The brand new legislation offers Medicare the facility to barter drug costs.

Anna Moneymaker/Getty Photographs

On Tuesday, the White Home celebrated the passage of the the Inflation Discount Act, a sweeping local weather, tax and well being care package deal handed in August. Amongst different measures, it grants Medicare historic new powers to regulate prescription drug costs.

Democratic leaders like U.S. Senator Chuck Schumer, D-N.Y., celebrated what they see as one of many legislation’s historic achievements. “For years, the naysayers stated we may by no means tackle the massive drug firms and decrease prescription drug prices however we did, and we gained,” Schumer stated.

However for the folks confronted with placing this legislation into follow, the work is simply starting. Now, federal authorities staff and pharmaceutical firms start a brand new spherical within the struggle over how a lot the huge Medicare program pays for prescribed drugs.

This spherical is shaping as much as be a bureaucratic brawl over the brand new legislation’s high-quality print, its loopholes and its legality. Here is what’s at stake and what stands in the way in which of Medicare benefiting from the brand new measures.

Medicare’s new powers to chop and cap prescription drug costs

Two of the largest battlegrounds will probably be a pair of recent powers that lawmakers gave Medicare, the federal insurance coverage program that covers 64 million seniors and folks with disabilities. Medicare’s roughly $180 billion annual drug finances accounts for greater than a 3rd of the nation’s whole drug spending.

One of many new powers lets the federal authorities negotiate deep reductions instantly with drugmakers for a few of the medication that value Medicare probably the most. This provision is unprecedented – and one which the pharmaceutical trade fought for many years.

To be eligible for negotiation, medication have to be among the many 100 merchandise costing Medicare probably the most cash, have been in the marketplace not less than a number of years, lack generic competitors, and be unaffected by a number of different exemptions within the legislation.

Regardless of these caveats, Medicare can nonetheless goal a few of the trade’s largest moneymakers, like Eliquis and Xarelto, a pair of blood thinning medicines that Medicare spent $10 billion on in 2020 and Januvia, a diabetes drug that racked up almost $4 billion in Medicare gross sales that very same yr.

Medicare will announce its first 10 targets subsequent September and the costs negotiated for these medication will take impact in 2026. The legislation permits Medicare to focus on extra medication every year thereafter, including as much as as many as 60 by the top of this decade.

The opposite new energy lawmakers gave Medicare is called the inflation rebate. It does have precedent. Medicaid, which covers 82 million low-income People, has used its inflation rebate energy for 30 years. It permits Medicaid to claw again any worth will increase that exceed the speed of inflation, and has considerably lowered Medicaid’s spending.

This provision, which applies to most medication, now permits Medicare to do the identical. It takes full impact in 2023, with Medicare planning to gather rebate funds for some medication as quickly as April.

Drugmakers usually hike product costs in January, so executives will probably be dealing with some necessary pricing choices very quickly, stated Sean Dickson, well being coverage director for the West Well being Coverage Middle, a nonpartisan group centered on decreasing well being care prices.

Numbers launched final week by the Congressional Finances Workplace estimate that collectively this pair of provisions would save Medicare about $170 billion over the following decade. However these financial savings are removed from assured.

Extra lobbying and lawsuits possible

Though the Inflation Discount Act is now legislation, lots of its essential particulars nonetheless must be stuffed out. That course of, referred to as rulemaking and steering, is the place consultants count on the pharmaceutical trade to shift its lobbying effort.

Many seemingly technical particulars may have main implications on this legislation’s influence. For instance, the textual content of the Act doesn’t clearly define how a negotiated worth will probably be calculated if bargaining between a drugmaker and Medicare ends in a stalemate.

Mark Newsom, a coverage guide who labored on the Facilities for Medicare and Medicaid Companies for a number of years, together with in 2004 when Medicare underwent main reforms, expects the drug trade to use heavy political and authorized strain on this rulemaking course of.

Quite a few consultants say they count on to see lawsuits difficult provisions of the legislation. One authorized goal might be an enormous tax penalty for firms who refuse to chop Medicare a deal.

“They’ll go to the Hill and ask for legislative change, or they are going to go to the courts and they are going to litigate,” Newsom stated.

Making the most of the legislation’s vulnerabilities

On the identical time, the drug trade can be laying plans for a world through which Medicare’s new powers do survive. “They’re completely making ready for implementation,” stated Alice Valder Curran, who advises drug firms on pricing technique on the legislation agency Hogan Lovells.

There’s loads of proof from Medicaid’s 30 years of implementing inflation rebates displaying how drugmakers work across the system.

“There is a lengthy monitor document of producers taking artistic methods to keep away from paying these rebates,” stated Dickson of West Well being Coverage Middle who beforehand suggested drugmakers on compliance with authorities pricing guidelines.

Sometimes, firms blatantly break the foundations, as evidenced in a latest $233 million settlement between the Division of Justice and drugmaker Mallinckrodt. Much more usually, although, stated Dickson, firms reap the benefits of the foundations, exploiting imprecise definitions, flawed formulation and different loopholes within the rebate legislation.

One space ripe for gaming is the system referred to as common producer worth that Medicaid makes use of to find out whether or not firms owe cash for climbing costs sooner than inflation. The legislation offers firms ample discretion in how they calculate that common, and companies have used that discretion to incorporate or exclude sure gross sales to keep away from triggering rebate funds. Only one loophole in that system, which Congress closed in 2019, had value Medicaid not less than $595 million per yr in misplaced rebates, in response to a report by the Workplace of Inspector Common for the U.S. Division of Well being and Human Companies.

The Inflation Discount Act basically duplicates the language of Medicaid’s inflation rebate legislation, making Medicare now susceptible to the identical loopholes. And drugmakers have rather more incentive to use them, stated Dickson. Firms make 3 times the income from Medicare than they make from Medicaid.

“It is a fixed effort to maintain churning by means of and discovering the place these vulnerabilities lie,” stated Amber Jessup, the chief well being care economist on the Workplace of Inspector Common for the Division of Well being and Human Companies, which screens federal well being packages for fraud, waste and abuse. Jessup added that it’s too quickly to know whether or not comparable vulnerabilities may lie inside the negotiation provision of this new legislation.

She stated that her staff of auditors, analysts, evaluators and legal professionals really feel the burden of this new problem. “There are numerous well being care {dollars} at stake.”

Making ready for the unprecedented

No matter conflicts lie forward, the Inflation Discount Act will usher in sweeping change in how Medicare pays for prescribed drugs. “It transcends any of the opposite pricing reforms I’ve ever seen, as a result of it’s so expansive,” stated trade advisor Alice Valder Curran.

That expansiveness has made the legislation’s long term implications tough to determine, particularly for big pharmaceutical firms with tons of of merchandise in the marketplace, every priced and paid for in numerous methods. “We’re actually nonetheless within the discovery section,” Curran stated.

Different trade consultants count on firms to contemplate quite a lot of responses to the legislation to make up for losses of their backside line, together with charging non-public insurers extra or climbing the launch costs of future medication — an space not regulated by this legislation.

About the one factor sure this early within the implementation of the brand new legislation is that drugmakers and the federal government officers who regulate them are each hurtling towards a brand new frontier. The race to map it, navigate it and thrive in it has simply begun.

This story was produced by Tradeoffs, a podcast exploring our complicated, expensive and infrequently counterintuitive well being care system.

[ad_2]