Writer: Gordon Feller, Wilson Heart

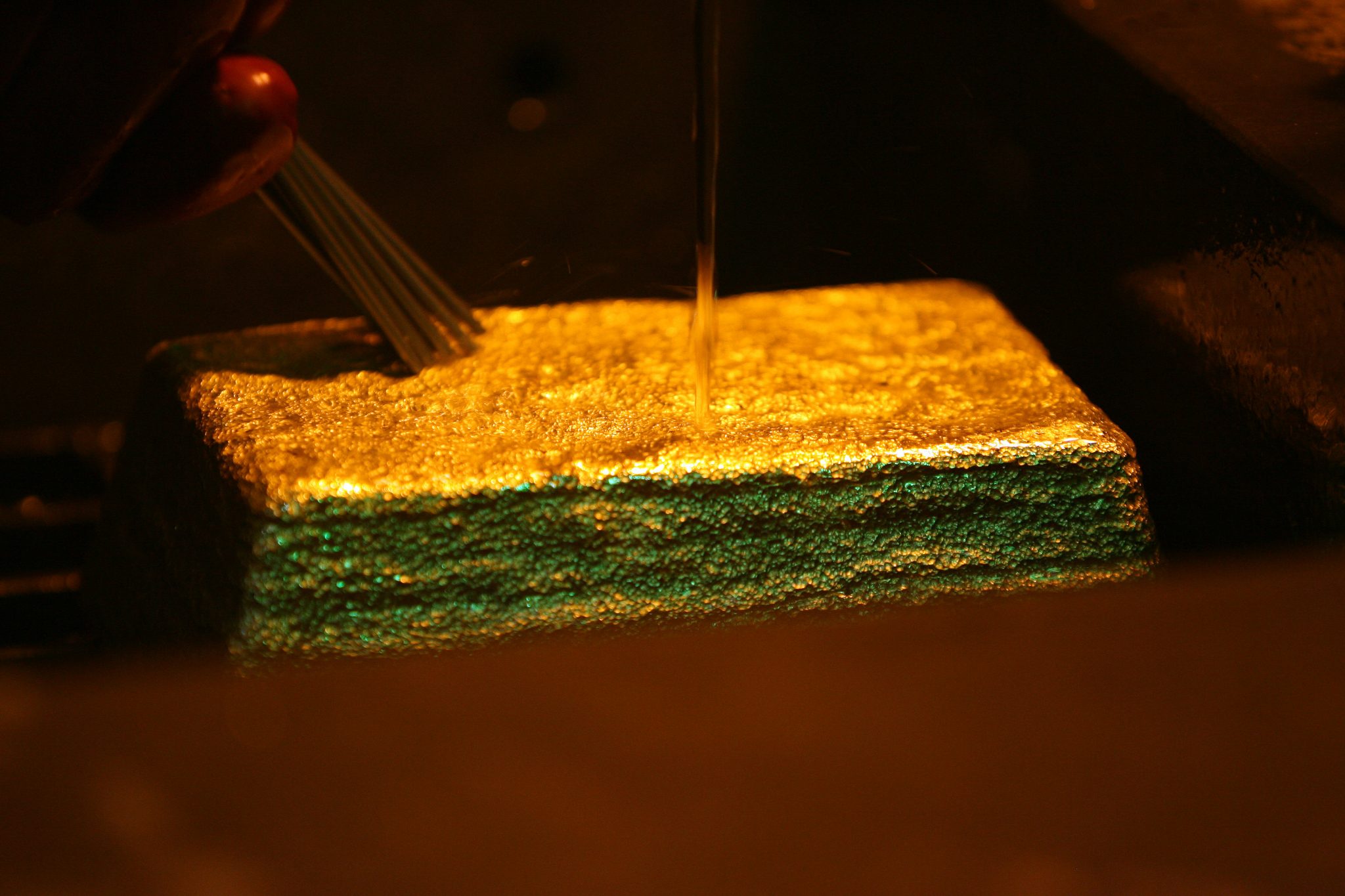

Mongolia’s dependence on mining has intensified in latest many years. Following the invention of main coal deposits and gold-copper ore within the early 2000s, its financial significance surpassed that of the normal livestock sector. In 2022, mining accounts for practically 1 / 4 of gross home product (GDP), up from a tenth in 2000.

![]()

Because the introduction of large-scale mining in 2004, Mongolia’s financial system has grown at a median charge of seven.2 per cent per yr, making it one of many world’s fastest-growing economies. Progress has translated to sustained poverty discount and enhancements in high quality of life with out a vital enhance in revenue inequality. Vital mineral revenues and a excessive stage of exterior borrowing have supplied assist to a beneficiant (however inefficient) social help system and a big public funding program.

But Mongolia’s speedy development has been obscured by its excessive macroeconomic volatility and frequent boom-and-bust cycles. Progress has virtually solely come by way of capital accumulation and the intensive use of pure capital slightly than sustained productiveness development. The elimination of utmost poverty owes extra to the beneficiant social switch system than to the creation of plentiful well-paying jobs. Local weather change and the COVID-19 pandemic are exacerbating these challenges.

As an alternative of utilizing mineral wealth to scale back its dependence on the extractive sector, Mongolia has develop into hooked on it. Such complacency is ill-timed, particularly as demand for key minerals is prone to tumble as a consequence of local weather change considerations, a shift in buyers’ desire towards sustainability, China’s bold aim to scale back coal consumption and the pandemic shock.

The deal with preserving mining-driven prosperity has meant the underutilisation of different components of manufacturing. Mongolia ranked 51st globally within the World Financial institution’s Human Capital Index, greater than its income-level rating (92nd), largely as a consequence of excessive instructional attainment. However Mongolia doesn’t make full use of this human capital. The nation is an outlier amongst friends within the utilisation of human-capital wealth in its manufacturing course of.

Mongolia’s efficiency on institutional capital (for instance, rule of legislation and corruption management) has additionally deteriorated in latest many years. The nation has considerably underperformed in comparison with its aspirational friends, as its development stays dominated by the exploitation of pure capital.

Is Mongolia’s prosperity being constructed on the expense of future development? A rising variety of specialists imagine that the nation is turning into over-reliant on mining-led development. The federal government is barely saving one cent of every greenback earned from its mineral output. With such a measly quantity of mineral income saved, it raises the query of the place the cash has gone. A comparability of the spending sample earlier than the arrival of mineral wealth (1998–2003) and after (2004–19) is revealing.

The general public spending sample didn’t change within the first few years of elevated mineral income, overlapping with a interval of a declining ratio of public sector debt to GDP. However coinciding with the 2008 common elections and persevering with by way of the subsequent two elections — in 2012 and 2016 — there have been spikes in spending on social transfers (3.1 per cent of GDP), public funding (6.3 per cent of GDP) and wages and pensions of civil servants (1.8 per cent of GDP). Since mineral revenues account for six.7 per cent of GDP throughout this era, so a few of the extra spending was financed by way of new borrowings.

Political comfort, not financial advantage, determines how mineral income is utilised. Underneath the idea that mineral revenues had been largely spent on the above three objects, practically 56 per cent of mineral revenues had been spent on public funding, 28 per cent on social transfers and 16 per cent on wages and pensions. Mongolia’s public funding program and beneficiant social transfers —inefficient by international requirements — have been cited as a doable trigger for anaemic productiveness development.

There are encouraging indicators of mineral revenues being invested extra prudently. As an alternative of utilizing revenues to high up social transfers and public funding applications, the federal government has allotted a big half to productive funds and to retire high-cost money owed. The interval 2017–19 marked a decisive shift in fiscal administration — fiscal steadiness in surplus in two of the three years, three consecutive years of decline within the public debt-to-GDP ratio and greater than 2.5 per cent of GDP transferred to the Fiscal Stability Fund and the Future Heritage Fund.

Whereas vital, these enhancements are inclined to reversal ought to their political architects depart workplace. The present administration of Mongolian President Ukhnaagiin Khurelsukh ought to construct on its observe report by introducing institutional adjustments that guarantee mineral revenues are prudently used no matter which celebration and persons are in energy.

A model of this text was first revealed right here in World Asia.

Gordon Feller is a World Fellow on the Smithsonian Establishment on the Wilson Heart and a recipient of the Abe Fellowship, supplied collectively by the Social Science Analysis Council and the Japan Basis Heart for World Partnership