[ad_1]

Article content material

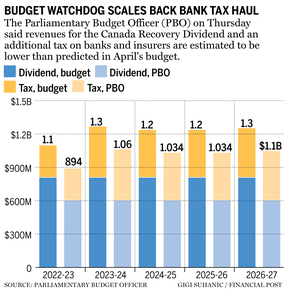

Two new taxes on Canadian banks and insurers may generate $5.3 billion over 5 years, the Parliamentary Funds Officer mentioned Thursday.

Article content material

The taxes, which Prime Minister Justin Trudeau proposed throughout final 12 months’s Canadian election marketing campaign, would usher in much less income than the $6.1 billion estimated in April’s price range.

Article content material

The PBO calculates that $3 billion will come from a one-time Canada Restoration Dividend. It is a 15 per cent surtax on domestically-generated earnings over $1 billion prior to now two years to be paid in equal instalments over 5 years.

Finance Minister Chrystia Freeland can be proposing a further improve of 1.5 proportion level to the company tax charge paid by banks and insurers on revenue over $100 million. This can generate one other $2.3 billion, the PBO mentioned.

Banks pushed again on the levy after Trudeau first introduced it on the marketing campaign path final 12 months.

The Canadian Bankers Affiliation (CBA) criticized the plan, accusing the federal government of “singling out” the monetary providers trade and saying the tax hit will “merely re-direct” financial institution earnings from Canadians — within the type of inventory dividends — to authorities coffers.

Extra reporting by Barbara Shecter, Monetary Put up

• Electronic mail: dpaglinawan@postmedia.com | Twitter: denisepglnwn

[ad_2]