Authors: Robyn Klingler-Vidra, KCL and Yu-Ching Kuo, Kaohsiung

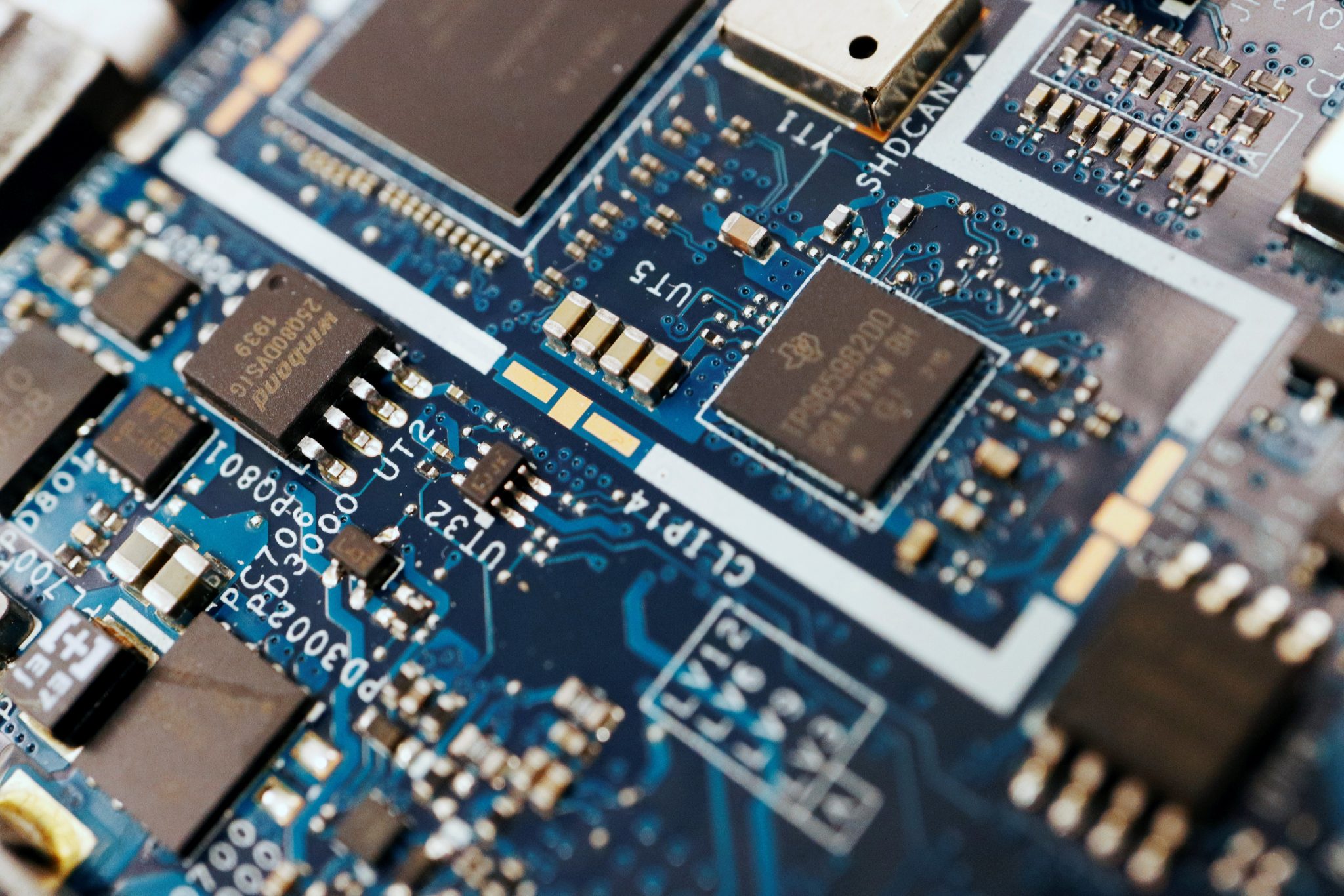

The significance of semiconductors to financial safety adorned newspaper headlines in 2022. As a part of its technological competitors with China, the US has launched a coverage of ‘friendshoring’ its semiconductor manufacturing to safe its provide of high-end chips that allow every day life and inventory the stock of main expertise companies resembling Apple.

![]()

The time period friendshoring rose to prominence after a speech by US Treasury Secretary Janet Yellen in April 2022. Yellen proposed a shift in direction of ‘favouring the friendshoring of provide chains to trusted international locations’, arguing that this may ‘decrease the dangers’ to the US economic system and its companions.

In an effort to spice up nationwide competitiveness, the US handed the ‘CHIPS and Science Act’ in August 2022 to reinforce home chipmaking capability via main funding in regional centres and help for expertise improvement. Washington’s efforts additionally embrace the Chip 4 alliance — an association via which the US authorities goals to diversify provide chains amongst Japan, South Korea and Taiwan.

The not-so-subtle intention is to frustrate the power of Chinese language producers to improve their capability. That may assist US companies keep a bonus over Chinese language companies like Semiconductor Manufacturing Worldwide Company (SMIC), which just lately reported the event of a 7nm chip, amongst different new capabilities. The Taiwan Semiconductor Manufacturing Firm (TSMC) is making ready to mass produce 3nm chips, whereas South Korea’s Samsung has simply begun 3nm manufacturing.

A lot of the protection of friendshoring has focussed on manufacturing and design capabilities, the market share of chip companies and political posturing. However friendshoring and the US Chip 4 coverage are in the end in regards to the folks, or ‘associates’, behind these technological improvements. Japan, South Korea, and Taiwan have chipmaking ‘godfathers’ — folks acclaimed for his or her essential roles in growing semiconductor capability. But a number of of those ‘godfathers’ have confirmed to be ‘frenemies’ to their very own corporations after being poached by opponents — together with Chinese language market entrants.

Yukio Sakamoto, dubbed the ‘godfather of Japan’s DRAM’, was the president of the previous semiconductor firm and foundry, Elpida Reminiscence. Sakamoto was disgruntled after his expertise on the US-based Micron and joined China’s Tsinghua Group in 2019 to construct DRAM merchandise. In June 2022, Sakamoto introduced he was becoming a member of China’s SwaySure. Sakamoto labored for Texas Devices in Japan earlier in his profession earlier than being recruited by Kobe Metal Digital Info Group.

Kim Choong-Ki is commonly known as the ‘godfather of South Korea’s Chip Business’. Kim skilled upcoming semiconductor engineers — known as ‘Kim’s mafia’— who went on to guide semiconductor manufacturing at Samsung, LG and Hyundai. Kim earned his PhD at Columbia College, after which he joined the then semiconductor trade big, Fairchild, the place he labored on R&D in Palo Alto.

Morris Chang based Taiwan’s semiconductor powerhouse, TSMC, in 1987 and led the agency’s development for many years. Chang obtained his PhD in electrical engineering at Stanford College, working for Texas Devices for greater than 25 years. The Taiwanese authorities quickly after recruited him to guide the soon-to-be-established ‘devoted silicon foundry’.

Chiang Shang-Yi headed R&D at TSMC till 2006. After navy service, he accomplished his undergraduate research at Nationwide Taiwan College and graduated with a PhD from Stanford College. He made headlines for becoming a member of the SMIC as an unbiased non-executive director from December 2016 to June 2019, changing into vice-chairman from December 2020 till November 2021.

Liang Meng-song, one other semiconductor doyen, was within the highlight of a courtroom case between TSMC and Samsung. He was charged with leaking labeled info to Samsung after becoming a member of the identical yr he left his long-time employer, TSMC. Liang, like Chang and Chiang, studied in the US. He spent 23 years working at TSMC earlier than leaving in 2009.

These ‘associates’ gained essential work expertise with US companies and most accomplished postgraduate research in the US. Sakamoto discovered throughout his time at Texas Devices whereas Kim and Chang, Chiang and Liang graduated from elite US colleges and labored for main US companies resembling AMD, Hewlett-Packard, Fairchild and Texas Devices. After returning house, they turned the manager officers of semiconductor companies or holders of mental property rights.

The US-led Chip 4 alliance has come to life amid the interaction between the long-standing private connections within the semiconductor trade and the danger of expertise shifting throughout companies and international locations, because the trajectories of those godfathers exemplifies. The motion of semiconductor professionals ignites wars over worker expertise and brings lawsuits regarding patents and commerce secrets and techniques, intensifying trade rivalry and competitors.

Whereas Washington’s friendshoring coverage goals to deepen provide chains with key producers in Japan, South Korea and Taiwan, policymakers should do not forget that the individuals who comprise the management of these companies can transfer. Friendships evolve over time, and associates be taught from each other. In Granovetter’s phrases, Washington’s ‘weak ties’ may show extra useful than its sturdy ties to South Korea, Japan and Taiwan in advancing its semiconductor capabilities.

Robyn Klingler-Vidra is Reader in Entrepreneurship and Sustainability at King’s Enterprise Faculty. She is the creator of The Enterprise Capital State: The Silicon Valley Mannequin in East Asia (Cornell College Press, 2018) and Inclusive Innovation (Routledge, with Alex Glennie and Courtney Savie Lawrence).

Yu-Ching Kuo is an unbiased researcher primarily based in Kaohsiung. She is the co-author of ‘Brexit, Provide Chains and the Contest for Supremacy: The Case of Taiwan and the Semiconductor Business’ in A New Starting or Extra of the Similar? The European Union and East Asia After Brexit (Palgrave Macmillan, 2021, with Robyn Klingler-Vidra).