- Malaysia is its third market after Indonesia and Philipines

- It’s investing in Payex, a BNM-licensed fee gateway supplier

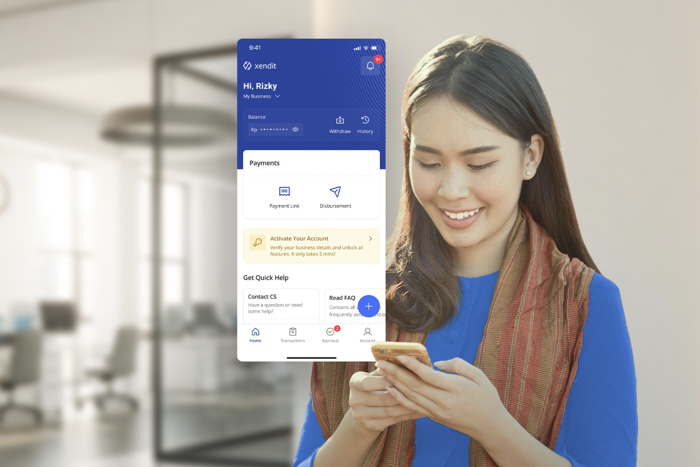

Xendit, an Indonesian based fintech firm, has formally entered the Malaysian market with its vary of fee options for SMEs, start-ups and big companies. The transfer was made following its announcement in 2021 to put money into Penjana Kapital by the Dana Penjana Nasional programme.

“We’re proud to be formally bringing our fee infrastructure and ecosystem to the Malaysian market – boosting the expansion trajectory of native start-ups by our safe and easy-to-integrate fee system,” stated Xendit founder and CEO, Moses Lo.

In the meantime, Xendit has additionally introduced that it’s investing in Payex, a Financial institution Negara Malaysia licensed fee gateway supplier, for an undisclosed quantity. The collaboration permits companies to faucet into the Indonesian, Philippine, Thai, Vietnamese, Malaysian, and different Southeast Asian markets.

“Our techniques are designed to simplify fee processes in all varieties, from standard to essentially the most in-demand conventional and different fee channels,” stated Xendit Malaysia Normal Supervisor, Jason Siew.

Xendit presents a one-stop fee infrastructure. This contains its core funds options that settle for funds from digital accounts, credit score and debit playing cards, eWallets, shops and direct debit.

It additionally presents services for the disbursement of funds to banks, eWallets and playing cards 24/7.

Moreover, Xendit additionally options a wide range of monetary companies, fee safety choices and value-added purposes comparable to card issuing, platform administration, infrastructure for eWallets, specific check-out, and extra.

The place it got here from

Xendit began in Indonesia in 2015. It accrued a listing of retailers and purchasers together with Traveloka, Seize and Tech in Asia. In 2020, it entered the Philippine market after which achieved unicorn standing in late 2021 following a profitable spherical of funding.

Xendit has over 3,500 lively prospects throughout the area and has recorded over US$21 billion (RM92.5 billion) in annualised third-party verifications throughout over 250 million transactions in complete.