Article content material

(Bloomberg) — Howdy, once more.

Article content material

All prepared for an additional week? Right here’s one thing to assist get you prepped.

Article content material

The massive stat: The US financial calendar will get slightly busier this week, with information on sturdy items, client confidence and residential gross sales due. The massive day to look at will likely be Friday, when the August private revenue and spending report that features the Fed’s most well-liked inflation gauge drops.

The massive Fed calendar: Recent off one other 75 foundation level price improve, Fed officers from Loretta Mester to Charles Evans, Raphael Bostic (who spoke of a “comparatively orderly” slowdown Sunday) and Lael Brainard will likely be making the rounds. Merchants will likely be parsing their feedback for clues as as to if coverage makers are leaning towards a fourth blockbuster hike.

The massive interview: John Paulson, who made billions shorting mortgage securities initially of the worldwide monetary disaster, tells Michael P. Regan that one other correction in frothy dwelling costs could also be on the playing cards. This time although, banks are a lot better positioned and we’re not liable to one other meltdown within the monetary system.

Article content material

The massive market thought: TINA was a mantra as soon as held pricey by fairness merchants. However with central banks displaying no indicators of slowing down their price hikes, buyers are progressively discovering that there are literally a panoply of options to shares that supply low-risk returns.

The massive vote: Barring any surprises, Italy is on observe to elect on Sunday its first far-right (and first feminine) prime minister since turning into a republic. If she wins, Georgia Meloni must cope with hovering power costs and borrowing prices and deal with Europe’s highest debt ranges. Right here’s a helpful information to what the vote will imply for monetary markets.

The massive earnings: With the Fed warning of extra ache to come back, firms are having to make powerful choices on find out how to navigate uncertainties across the tempo and severity of a world financial slowdown. Nike and Mattress Tub & Past are among the many key names to be careful for this week.

Article content material

The massive opinion: Nobody would name the US, with its federal finances deficit of greater than 3% of GDP — fiscally conservative. However it more and more appears just like the cleanest of the soiled shirts amongst main economies and that’s mirrored within the buck, writes Robert Burgess in Bloomberg Opinion.

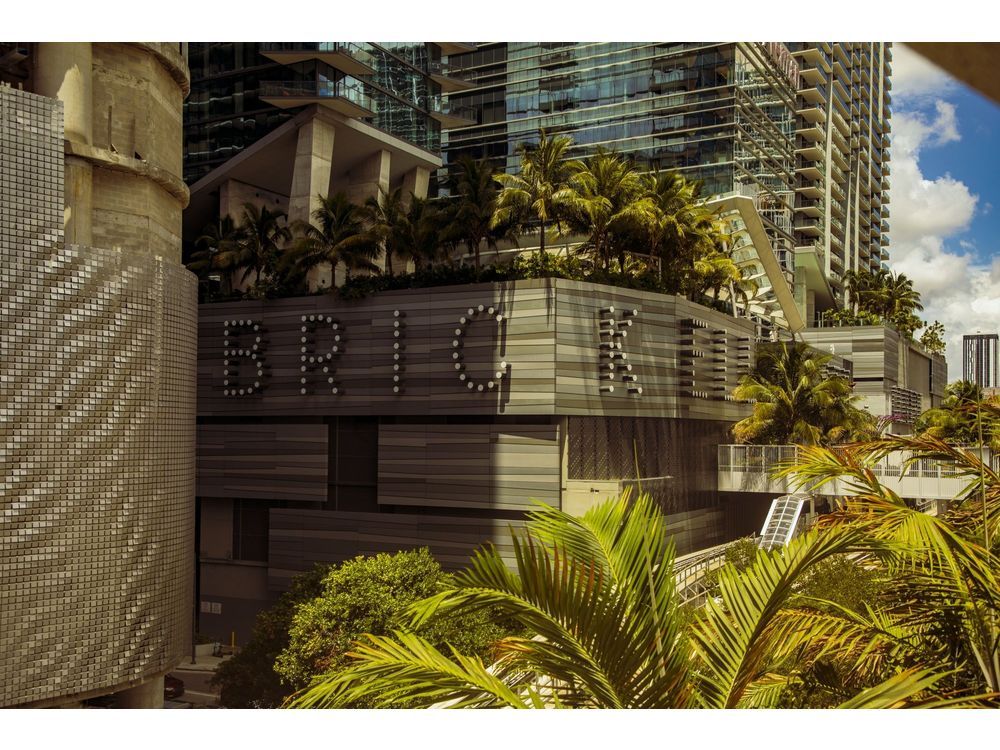

ICYM our Massive Take: Miami has well-known for its nightclubs, seashores and Little Havana. And in just a few years, it may additionally grow to be a new US capital of finance and tech, if Ken Griffin has his manner. Amanda L Gordon appears at how Citadel’s billionaire founder intends to reshape the Florida metropolis .

And at last, typically it appears like it’s worthwhile to be a rocket scientist to commerce trendy markets efficiently. Properly, George Patterson was one, earlier than he grew to become the chief funding officer of PGIM Quantitative Options. Take heed to his dialog with the “ What Goes Up” podcast.

Have a superb week. See you on the opposite facet.