Europe’s industrial giants have fretted for months that gasoline shortages this winter will cripple manufacturing. However even with gas out there, firms are discovering they’ll’t afford it.

![4joi0wcv]jpb963aa5d1(nga_media_dl_1.png](https://smartcdn.gprod.postmedia.digital/financialpost/wp-content/uploads/2022/09/price-squeeze-chemical-imports-to-germany-jump-as-energy-co-1.jpg?quality=90&strip=all&w=288&h=216)

Article content material

(Bloomberg) — Europe’s industrial giants have fretted for months that gasoline shortages this winter will cripple manufacturing. However even with gas out there, firms are discovering they’ll’t afford it.

Commercial 2

Article content material

“It’s not about shutdowns. It’s pricing, it’s value,” stated Christian Levin, chief govt officer of Traton SE, the truckmaking unit of Volkswagen AG.

Article content material

Europe is paying seven instances as a lot for gasoline because the US, underscoring a dramatic erosion of the continent’s industrial competitiveness that threatens to trigger lasting harm to its financial system. With Russian President Vladimir Putin redoubling his battle efforts in Ukraine, there’s little signal that gasoline flows — and considerably decrease costs — can be restored to Europe within the close to time period.

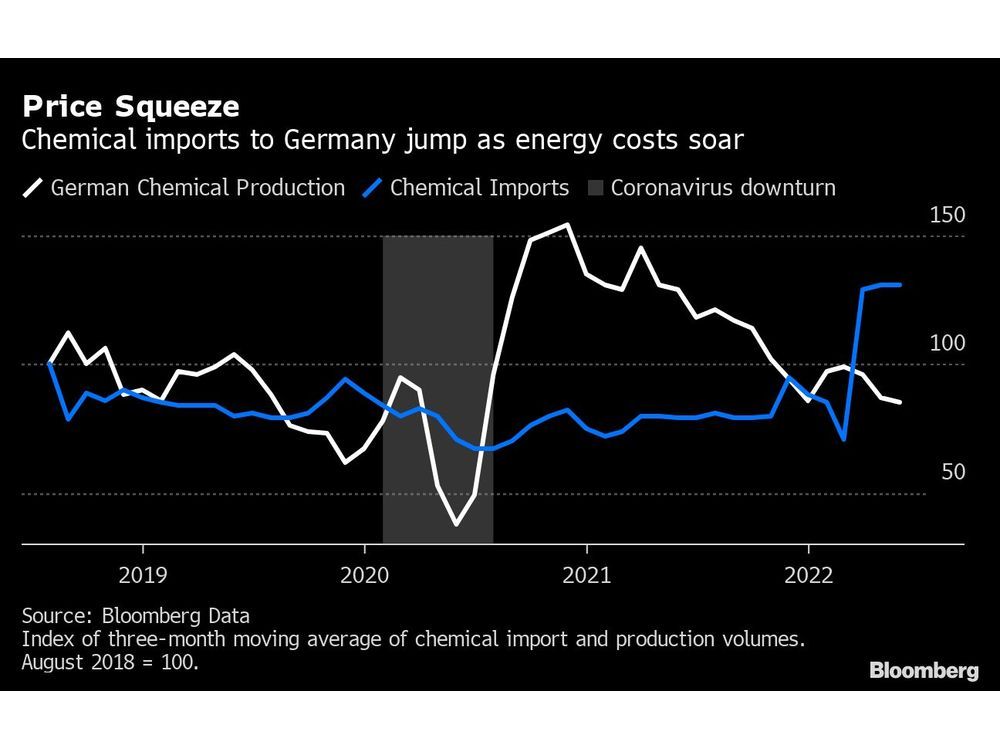

Indicators of an financial transformation are already afoot: Germany, Europe’s greatest financial system, has seen its regular commerce surplus dwindle because the surge in imported vitality prices offsets its high-value exports of vehicles and equipment, and chemical firms started shifting manufacturing exterior the nation. Final month, German producer costs jumped by a file 46%.

Commercial 3

Article content material

Plastics maker Covestro AG gained’t make development investments in Europe if the disaster persists and as a substitute look to Asia, the place Chief Govt Officer Markus Steilemann stated the corporate can safe vitality at costs 20 instances cheaper than within the German and European spot market. Volkswagen, Europe’s greatest carmaker, warned Thursday that it may reallocate manufacturing out of Germany and japanese Europe if vitality costs don’t come down.

Chancellor Olaf Scholz will journey with a gaggle of enterprise leaders to the Center East this weekend as he tries to nail down offers for liquefied pure gasoline with Saudi Arabia and Qatar to make up for Russia’s cuts.

However negotiations have been tough, with gasoline suppliers together with Qatar enjoying hardball over the worth and length of potential agreements, German officers have stated. Discussions with suppliers in Europe and North America have confirmed equally advanced, underlining the uphill wrestle Scholz faces in locking down provides at costs that can hold Germany’s financial base aggressive.

Commercial 4

Article content material

Covestro expects its gas invoice to high 2.2 billion euros ($2.2 billion) in 2022, nearly 4 instances its prices in 2020, the yr earlier than Russia began choking off gasoline provides to Europe.

“On the present worth stage, energy-intensive German business is not globally aggressive,” a Covestro spokeswoman stated. “For plenty of chemical compounds, imports from the US or China are already cheaper than producing them domestically.”

The place attainable, producers together with Volkswagen and BMW AG are shifting from gasoline to grease or coal to maintain services working. However some energy-intensive manufacturing — akin to metals, paper and ceramics — has change into unfeasible, prompting a rising variety of firms to close down, shift manufacturing overseas or, like chemical large BASF SE, to import key supplies like ammonia from opponents. Mercedes-Benz AG has really ramped up manufacturing of key auto components to stockpile in case it has to shut German factories.

Commercial 5

Article content material

“These burdens are inflicting lasting harm to the commercial core of our financial system,” stated Christian Seyfert, managing director of VIK, a gaggle that represents energy-intensive firms. “We urgently advise politicians to take decisive motion in order that Germany and Europe as a enterprise location will not be fully left behind internationally.”

Governments throughout Europe, the place industrial manufacturing accounts for roughly 1 / 4 of the financial system, are taking emergency actions to shore up utilities and cushion the influence of the disaster. The UK this week introduced an estimated £40 billion ($44.8 billion) plan that might cap wholesale vitality costs that feed into gasoline and energy contracts for companies for six months.

Commercial 6

Article content material

Germany, due to its heavy reliance on Russian gasoline, has been hit more durable by the vitality scarcity than a lot of its neighbors. However the remainder of the continent is underneath related duress. In France, glassmaker Duralex, situated close to Orleans stated it’s placing its oven on standby for five months regardless that the corporate’s order guide is full and gross sales are rising.

“Persevering with to supply at present costs can be a monetary aberration,” stated Jose-Luis Llacuna, president of Duralex, which exports to 110 nations and had its Picardie mannequin featured within the James Bond film “Skyfall.”

French President Emmanuel Macron on Thursday urged small and medium-sized companies to carry off on signing new vitality contracts at “loopy costs,” saying governments are within the means of renegotiating gasoline and electrical energy prices.

Commercial 7

Article content material

The stakes are maybe highest in Germany, the place industrial manufacturing makes up roughly 30% of the financial system and employs round 1.15 million folks. Vitality-intensive factories throughout the nation provide every part from gearbox parts for vehicles to the chemical compounds for medicines and on a regular basis plastics. Covestro, which makes supplies for the constructing and automotive industries, stated demand is beginning to break down.

“We’re slowly dropping our clients,” Steilemann stated. “We’ve an elevated variety of insolvencies, an elevated variety of closures and really restrained buying.”

Germany stated this week it’ll nationalize Uniper SE, the nation’s largest gasoline importer, with an 8 billion euro capital injection, and the nation is poised to impose a gasoline levy on Oct. 1 that spreads the ache of hovering wholesale vitality costs to households and companies.

Companies have decried that plan.

“Our firms can not address any additional burdens,” stated Wolfgang Grosse Entrup, President of the chemical affiliation VCI, a company that represents the likes of BASF and Evonik Industries AG, key suppliers to Germany’s carmaking sector. “The state of affairs is changing into increasingly more drastic.”