The European Central Financial institution is unlikely to step straight into foreign-exchange markets even within the face of a greater than 10% droop within the euro this yr, though there’s potential for Japan to interact in that sort of intervention if the yen continues to unravel, in line with Goldman Sachs Group Inc.

Article content material

(Bloomberg) — The European Central Financial institution is unlikely to step straight into foreign-exchange markets even within the face of a greater than 10% droop within the euro this yr, though there’s potential for Japan to interact in that sort of intervention if the yen continues to unravel, in line with Goldman Sachs Group Inc.

Article content material

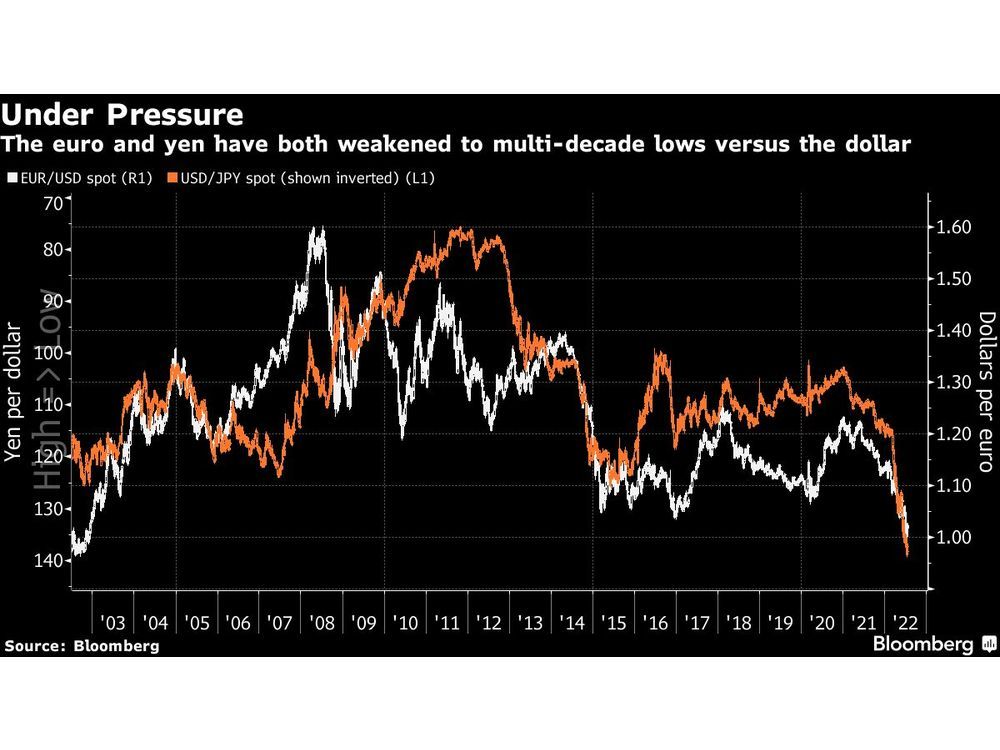

The US greenback, fueled by a mixture of aggressive Federal Reserve financial coverage and haven shopping for, is buying and selling close to its strongest degree in a long time, steamrolling currencies from Hungary to New Zealand. The euro and yen — the buck’s most generally traded friends — have struggled to carry their floor, whereas some international locations corresponding to Chile and India have already taken direct motion in help of their currencies.

But the chances such a transfer by the ECB within the near-term are low, in line with Goldman foreign-exchange strategist Karen Reichgott Fishman, who says President Christine Lagarde and her colleagues have extra urgent points to sort out earlier than shifting their consideration towards re-strengthening Europe’s frequent forex. Excessive on that listing are the continued surge in inflation, dangers to power provides, and the deterioration of so-called peripheral bond markets, like Italy’s, whose points are being exacerbated by ongoing political turmoil.

Article content material

These issues underpinned the financial institution’s resolution earlier Thursday to elevate its benchmark fee by half a proportion level — its first improve in a decade — and supply additional particulars about its latest bond-market instrument, which is geared toward stopping a splintering of the euro space.

It’s Sophisticated

“Issues of fragmentation dangers and elevated political uncertainty in Italy in the end outweighed the preliminary upward strain on the euro — highlighting the sophisticated set of challenges the one forex is dealing with for the time being,” the Goldman strategist wrote in a report printed Thursday. Whereas FX intervention is definitely “within the toolkit” the chance of the ECB deploying it’s “low,” in her view.

In the meantime, the Japanese yen is down greater than 16% towards the buck thus far this yr and earlier this month touched its weakest degree since 1998. Financial institution of Japan Governor Haruhiko Kuroda emphasised Thursday his willpower to stay with rock-bottom rates of interest even when it means a weaker yen.

But how lengthy the BOJ can stand pat as its forex plummets may be very a lot an open query nonetheless. Reichgott Fishman notes that whereas interventions by the world’s largest central banks have been uncommon in latest a long time — and once they do happen they’re sometimes co-ordinated amongst a number of financial authorities — the chances that Japan would possibly do one thing will improve if the dollar-yen fee pushes even greater.