The USA unemployment charge stays at a historic low of three.6 p.c at the same time as inflation spikes and the economic system slows.

Fewer People utilized for unemployment insurance coverage for the primary time in 4 weeks, however the quantity continues to be the very best since November, suggesting that the economic system could also be slowing down.

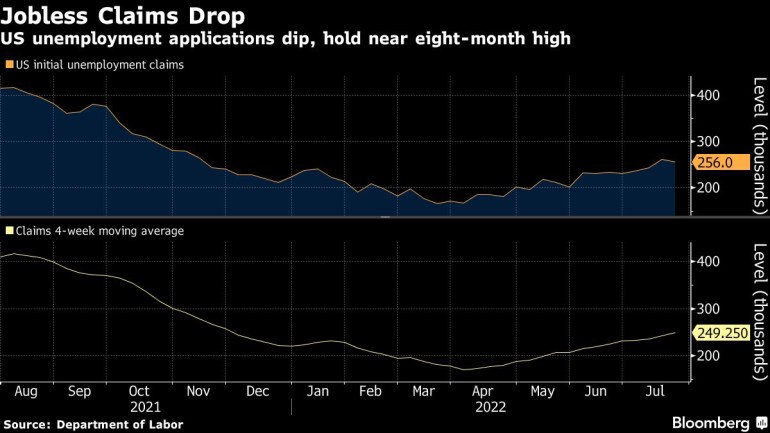

In line with the US Division of Labor, functions (PDF) for unemployment advantages for the week ending July 23 declined by 5,000 to 256,000 from the earlier week’s 261,000. The variety of claims for the week of July 16 was revised upward by 10,000 from the earlier estimate of 251,000.

The four-week common for claims, which smooths out among the week-to-week volatility, rose by 6,250 from the earlier week, to 249,500. That quantity can also be at its highest degree since November of final 12 months.

For the week ending July 16, there have been 1,359,000 People receiving unemployment advantages, a lower of 25,000 from the earlier week. For months, that quantity has been near 50-year lows.

The Labor Division earlier this month introduced that corporations added 372,000 jobs in June, a shock improve and a charge similar to the previous two months. Given the extra basic indicators of financial deterioration, economists had anticipated that job progress would decline considerably final month.

For the fourth consecutive month, the unemployment charge stayed at 3.6 p.c, matching a low that had not been seen in practically 50 years.

Nonetheless, complete demand for labour stays excessive. The US authorities earlier this month introduced that corporations posted fewer positions in Might amid considerations that the economic system is weakening. For each particular person who’s unemployed, there are presently nearly two job vacancies.

And whereas the labour market seems sturdy, corporations like Tesla, Netflix, Carvana, Redfin, Coinbase and Shopify have lately introduced layoffs. Different corporations have mentioned they might sluggish hiring.

American buyers’ sentiment has additionally taken a significant hit in latest months. The Shopper Confidence Index fell for a 3rd straight month to 95.7 from a downwardly revised 98.4 studying in June – the bottom studying since February 2021. People are being extra cautionary with their spending.

There are different indicators pointing to a persistent slowdown within the US economic system. On Thursday, the Commerce Division mentioned that the US economic system shrank 0.9 p.c within the second quarter, the second-straight quarterly contraction. Two consecutive contractions in gross home product (GDP) have historically signalled {that a} recession is on the horizon.

Shopper costs proceed to soar, up 9.1 p.c in June in contrast with a 12 months earlier, the most important yearly improve in 4 a long time. On Wednesday, the Federal Reserve raised its rates of interest by 75 foundation factors. The US central financial institution had beforehand raised charges by the identical quantity following its June assembly. In Might, it elevated borrowing prices by a half level.

The speed will increase are having an influence on the economic system as nicely. Larger mortgage charges have despatched residence gross sales tumbling after a growth in the course of the coronavirus pandemic induced costs to succeed in report ranges. Larger charges have additionally made the method of shopping for a brand new automotive harder and pushed bank card charges up.